The Automotive Industry in the Context of Digitalization

What exactly makes the automotive industry so complex compared to other sectors? The decisive factor is that the elements installed in the vehicle require a high level of technical resources. With a few exceptions, car production takes place in an industrial line production. This line production is characterized by a high degree of automation. Car manufacturers strive for the principle of customized mass production in order to achieve economies of scale. This principle requires factory automation and modularization.

The aim is a strategic-operational approach in which production only begins after the customer order has been placed. This production strategy is also known as build-to-order. This is another reason why a high degree of automation is required. As such, the use of robotics, including industrial robots, is highest in the automotive industry. The following text will specifically address the topic of wireless IoT technologies and automation in the automotive industry.

Vehicle Development and Research

The automotive industry invests heavily in research and development in order to develop new vehicle technologies, designs, and materials. This includes areas such as alternative drive systems, autonomous driving, connectivity, safety technologies, and much more.

Pre-Series

It can take years before a prototype is ready for series production. This process is also known as pre-series production. The vehicles from this production are referred to as pilot series.

Automobile Production

This refers to the industrial production of vehicles. Vehicles, assemblies, and parts are manufactured in numerous production facilities worldwide. A high level of networking between the plants is strived for, as it enables transparency and efficiency. Today, production is standardized according to production systems. Automotive production includes foundries, pressing plants, shell and body construction, paint shop, interior fittings, exterior fittings, gear construction, engine construction, final assembly, and quality assurance.

Supplier Industry

The supplier industry consists of companies that manufacture and supply components, parts, and systems for vehicles. These include, for example, engines, wiring harnesses, interior trim, batteries, and electronics. Companies that offer services such as design, engineering, and manufacturing are also considered suppliers.

Vehicle Supply

Automotive manufacturers are supplied by hundreds of suppliers. Production downtimes due to missing components cause high downtime costs. The automotive supply chain must therefore function smoothly and punctually on a just-in-time basis. IoT tools reduce the cost of delivering pipeline inventories and increase planning reliability.

Distribution and Retail

Although distribution is not part of the manufacturing industry, there is a strong dependency on manufacturing companies. This applies the influence of identification components from production on delivery dates and the after-sales area. This is the case, for example, with after-sales activities in connection with car tires.

Maintenance, Repair, and Spare Parts Logistics

The automotive industry also includes companies that provide maintenance and repair services for vehicles, be it through authorized workshops, independent workshops, or mobile service providers. This includes regular maintenance work, repairs, inspections, and parts replacement.

Digitalization and IoT in the Automotive Industry

In Germany, in particular, the automotive industry is considered a key industrial sector. The coronavirus crisis and the associated disruptions to material flows and sales markets have made the need to integrate IoT in the automotive industry even clearer. Topics such as the shortage of skilled workers, re-globalization, new work, sales markets in Asia, the price war for the cheapest electric car, and the requirements of factory automation are the focus of attention.

Various adjustments are necessary in order to master the structural change in the automotive industry. On the way to successful digitalization, the metaverse and Manufacturing X need to be incorporated into strategies and planning. Cloud computing in the automotive industry is just as much a part of this as artificial intelligence in the automotive industry. In this decade, the automation of manufacturing processes is no longer limited to the mere identification of components, container management, the networking of Internet of Things (IoT) devices, and the interoperability of data, but also includes artificial intelligence, embedded systems, machine learning, battery and hydrogen technology, simulation, and additive manufacturing.

It is clear that wireless IoT technologies will be a key pillar for the growth of digitalization and the optimization of production processes in the automotive industry. In addition, cloud computing also provides important insights that enable new and flexible business models with an impact on the entire value chain.

Which Wireless IoT Technologies Are Used in the Automotive Industry?

Products Designed for the Automotive Industry

This compilation shows that the number and variety of wireless IoT hardware in the automotive industry is immense. The main identification technologies used are RFID transponders and Bluetooth LE sensors, as well as the associated reading and writing devices and gateways. The objective of labeling is to uniquely identify a component or device; Bluetooth LE sensors are also used to capture status data. Intelligent sensors that measure distances, speeds, accelerations, or environmental data are also installed in vehicles. These sensors are primarily used as driver assistance systems, for environmental monitoring, and ultimately enable autonomous driving.

In combination with Ultra Wide Band (UWB) technology, the exact location of a component or an IoT device can also be determined. In addition to RFID and Bluetooth LE systems, Wi-Fi networks are being set up to enable the wireless connection of machines, control systems, and entire plants. In addition, IoT gateways and edge computing devices are used in production facilities to process and analyze data close to the source. This enables real-time responses to events, reduces the cost of data transmission, ensures connectivity in the automotive industry, and improves data security. Automated guided vehicles (AGVs) and robots are also used in production.

Application Areas of Wireless IoT in the Automotive Industry

Overall, the automotive industry, like other industries, is all about optimizing all production steps, predictive maintenance, increasing the efficiency of the supply chain and spare parts logistics, quality assurance, speed, and cost reduction. All processes that can be automated and thus make the entire production process more controllable, faster, more transparent, and also more virtual, are therefore important goals of digitalization. In simple terms, these automation initiatives can be summarized as follows: industrial marking and labeling, unique identification, determining statuses, capturing data, processing and preparing big data, enabling connectivity, forward-looking planning, and digitalization.

By using wireless IoT sensors which continuously collect data from vehicle components such as engines, gears, and brakes, car manufacturers can develop predictive maintenance models. These models predict potential failures or signs of wear and tear before they occur, enabling vehicle owners to carry out proactive maintenance to avoid costly downtime.

Big data solutions combined with artificial intelligence and machine learning enable Manufacturing X in the automotive industry. In addition to automation solutions for vehicle production, numerous solutions for vehicle safety are also being used. These include vehicle diagnostics and maintenance, as well as driver assistance systems.

In addition, vehicles can be protected against theft and monitored during transportation with the help of Global Positioning System (GPS) and RFID technology. These technologies facilitate logistics planning and enable a rapid response if risks or security problems arise.

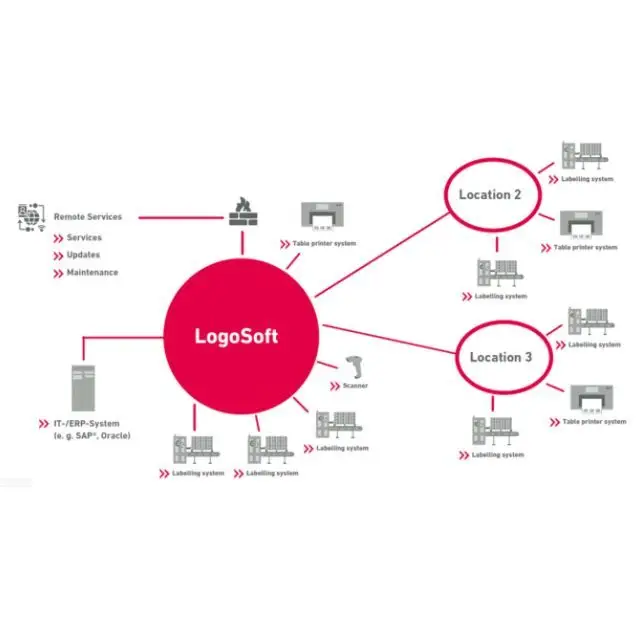

Groupe Renault Digitalizes Production with OPC UA

Groupe Renault has been using the OPC UA communication standard from the OPC Foundation since 2017 to enable end-to-end data communication from the sensor to the cloud and back. 12,500 OPC UA-enabled devices are already in use at 29 of Groupe Renault's 38 production sites. Production was digitalized on the basis of OPC UA and OPC UA-based Companion specifications. Adapters and gateways were used to ensure a uniform data structure between all systems.

The networking of sensor data (Publication Topics) and sensor configuration (Command Topics) in OPC UA takes place via MQTT. This enables not only the transfer of sensor data to the cloud, but also the control of machines with sensor data from the cloud. The Google Cloud Platform is used for data capture.

“I have 35 years of experience in the automotive industry and started my career in the maintenance of an automotive production facility. This initial experience led me to the design of industrial equipment and the programming of programmable logic controllers (PLC) and industrial computers (PC). I have managed numerous projects in the field of industrial automation and robotics around the world. In 2016, my interest shifted to digital transformation and the concept of the smart factory. I am convinced that standardization is the key to the success of transformation projects and their scalability.”

Thierry Daneau

Expert Leader Industry 4.0

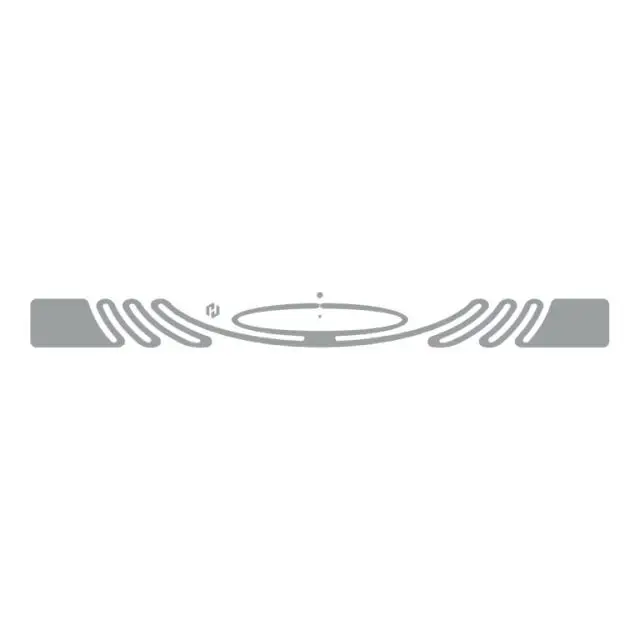

Tire Manufacturer Aims to Digitize the Tire Industry with UHF RFID

As an innovative leader, Michelin drives market transformation and adoption. Michelin truck tires are already equipped with RFID, and by early 2025, Michelin will have the capacity to produce 100% of passenger car and light truck tires with RFID. These tags are provided by Beontag, Hana RFID and Murata and are embedded into the side wall of the tires. This enables every tire to be tracked across the entire supply chain, up to the end of the tire’s lifecycle. The tags are coded with SGTIN-96 GS1 standard. This number is unique for every tire.

A handheld reader or stationary device with an industrial antenna is used to capture the tag data. The tags enable a standardized access to tire data. In 2022, the Global Data Serve Organization for Tires and Automotive Components (GDSO) was created with the objective to standardize tire data and manage the service to retrieve data from several tire manufacturers based on a unique item identifier (SGTIN-96). This way, key stakeholders like car manufacturers, distributors, and partners have secure access to tire data.

As an innovative leader, Michelin drives market transformation and adoption. Michelin truck tires are already equipped with RFID, and by early 2025, Michelin will have the capacity to produce 100% of passenger car and light truck tires with RFID. These tags are provided by Beontag, Hana RFID and Murata and are embedded into the side wall of the tires. This enables every tire to be tracked across the entire supply chain, up to the end of the tire’s lifecycle. The tags are coded with SGTIN-96 GS1 standard. This number is unique for every tire.

A handheld reader or stationary device with an industrial antenna is used to capture the tag data. The tags enable a standardized access to tire data. In 2022, the Global Data Serve Organization for Tires and Automotive Components (GDSO) was created with the objective to standardize tire data and manage the service to retrieve data from several tire manufacturers based on a unique item identifier (SGTIN-96). This way, key stakeholders like car manufacturers, distributors, and partners have secure access to tire data.

"RFID improves end to end tracability and quality, is used for efficient inventory management, optimized logistics, and the accurate allocation of tires to rims. RFID can also support quality and compliance management in the value chain. The identification numbers of RFID-tagged tires, for example, are linked to the vehicle identification number. Last but not least, RFID is the enabler chosen to support the future digital product passport (DDP) for tires in Europe and enhance end-of-life management.”

Christophe Duc

RFID Initiative and Service Model Leader, Car Manufacturers & Distribution

More Articles on the Automotive Industry

Is Digitalization in the Automotive Industry Progressing Slowly?

In today's world, vehicles are indispensable for being mobile, traveling comfortably, ensuring the supply of goods, and for transporting goods. Expectations of comfortable and individual mobility have risen steadily in recent years. New mobility concepts that reflect a new environmental awareness have emerged on the market, primarily as a result of socially driven activities that promote sustainability for companies. As a result, the automotive industry is confronted with numerous technological innovations and advances.

Technological innovations include electric vehicles, wireless sensor technology for autonomous driving, connectivity, and IoT platforms, in-vehicle assistance systems, diagnostic systems, and new mobility services. In the field of production, the automotive industry will increasingly benefit from new technological developments in the future. These include artificial intelligence, machine learning, robotics, augmented reality (AR), virtual reality (VR), driverless transport systems, new drive solutions, printed electronics, and data communication standards such as OPC UA and Omlox. For these reasons, car manufacturers are investing heavily in research and development in order to develop innovative solutions themselves and gain competitive advantages.

For the reasons mentioned above, it can be said that digitalization in the automotive industry is progressing more quickly rather than slowly, even if this development faces challenges due to the complexity of the industry as a whole. However, it is not only technological innovations and their impact on production that have a far-reaching influence on digitalization concepts in the automotive industry, but also social changes. Customer behavior has changed. Vehicle users increasingly desire digital experiences and connectivity in their vehicles.

The automotive industry is therefore striving to develop vehicles that enable a high degree of digitalization, connectivity, and autonomy, while at the same time, vehicle users want lower fuel consumption and thus a reduced CO2 footprint. In addition to societal changes, however, it is also the pressure from the market itself that is accelerating digitalization. New market players such as Tesla, Google, and Apple are entering the market. Another signal from the market itself is cost pressure and increased efficiency. Production processes must be continually optimized in order to reduce costs, while digitalization and automation enable increased efficiency and quality assurance in the automotive industry.

Partners Spezialized in the Automotive Industry

Industry 4.0 in Automotive Production

With regard to the prospects for the automotive industry, numerous buzzwords relating to technological progress in the automotive sector have already been mentioned in the previous section. In addition to artificial intelligence and machine learning, it is above all the goals of digitalization and automation that will have the greatest impact on the development of the automotive industry in the future. In the course of automation and the integration of wireless IoT technologies, millions of data and data sets are input into IoT platforms to feed analysis tools with big data. Artificial intelligence and machine learning enable numerous production optimizations and technological innovations based on big data.

Advances in technologies such as artificial intelligence, machine learning, simulation, digital twin, Industry 4.0, connected and additive manufacturing, Internet of Things (IoT), big data analytics, cloud computing, 5G connectivity, and blockchain are creating new opportunities for digital applications in the automotive industry. These technologies enable car manufacturers to develop connected vehicles, intelligent production systems, advanced driver assistance systems, and much more. These examples show how digital transformation will change the automotive industry. Safety, efficiency, sustainability, user experience, paired with new mobility concepts and new business models are all part of this.

Challenges in Data Communication

Despite the numerous potentials and technological innovations in the automotive industry, the automation and digitalization of vehicle production also faces major challenges. Like any transformation and disruption, technological innovations also mean that all previous and traditional production processes must be reviewed and adapted, investments in wireless IoT technology, for example, are necessary, and in order to generate and semantically utilize big data, OPC UA, for example, must be introduced.

In addition to the topic of data communication, the automotive industry must also deal with topics such as vehicle-to-vehicle communication (V2V), vehicle-to-infrastructure communication (V2I), and vehicle-to-everything communication (V2X). The topics of data protection and cyber security are on the agenda here, as the increasing networking and digitalization of vehicles also increases the risk of attacks. Additional security measures must protect vehicles from hacker attacks.

While the automotive industry is undergoing massive structural change, the coronavirus crisis has also shown that material flow systems are sensitive or can collapse completely. As the automotive industry relies on a complex supply chain with hundreds of suppliers, it makes sense to include suppliers in all digitalization initiatives. This is also a challenge for the automotive industry.

-6-9-23-responsive.webp)